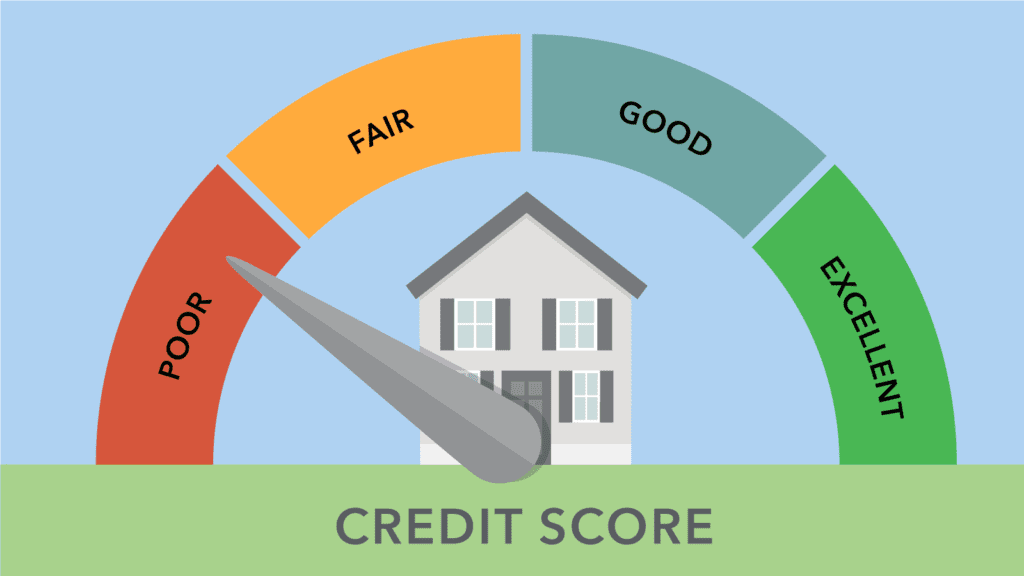

What are the minimum credit scores required for each of the loan products we offer? We can approve a lower credit score than most lenders and banks because we look at the whole credit history. A credit score is just one of the factors that show if a person is responsible with the debt obligations that they have. Housing payments, installment loans, and revolving credit that report on time payments over a period of time are good indicators that the person has the discipline and responsibility to make their mortgage payments on time each month. The general guideline for most loan programs is a period of 12-24 months that may require on time payments.

Credit scores are affected by many things. Some of the reasons someone may have a lower credit score may be due to very limited credit history, late payments, high credit utilization, charge offs, foreclosures, collection accounts, and bankruptcy. Many of these are caused due to people just not having learned to be responsible yet, or life events such as medical issues and divorce. That is why the different loan programs take a look back over the past 12 and 24 months. (It can be more depending on the particular circumstances).

So, what is the minimum credit score required? The baseline credit score that we require to be able to move forward with your application are the following:

– Conventional: 620

– VA: 500

– FHA 3.5% down payment: 580

– FHA 10% down payment: 500

– USDA: 580

Even if you aren’t ready right now we can take a look at often be able to offer simple advice that will help you increase your score. If you are ready to see if you qualify reach out to us today through the contact form, email, or phone call. We look forward to helping you!